Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Euro exchange rate fell to its lowest level since early July

- Fed rate cut expects to suppress the US dollar, pay attention to PPI and initial

- Bank of Japan's interest rate hikes heat up, USD/JPY is aiming at the 149 mark

- The market no longer steps on the brakes and dances delicately with Trump's poli

- Seven major events to happen in the global market this week

market news

In the early morning, the eagle's cry pushed the U.S. index, and gold and silver were under pressure.

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The eagle calls in the early morning to push the US index, and the gold and silver pressure range is empty." Hope this helps you! The original content is as follows:

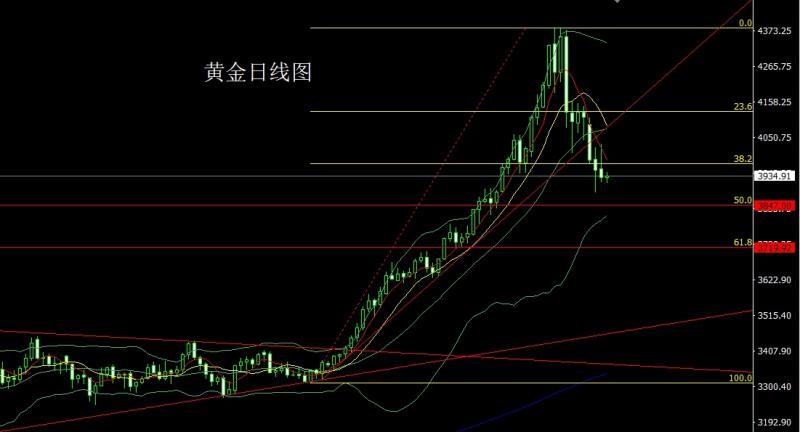

Yesterday, the gold market opened at 3955.3 in early trading. After that, the market fell first and reached a daily low of 3915.1. Then the market rose strongly. The daily high reached 4 during the US trading session. After the position of 030.4, the market fluctuated and fell back. In the early morning period, the market fell sharply due to the basic impact. The daily line finally closed at the position of 3930.2, and then the market closed in the form of an inverted hammer with a very long upper shadow line. After this pattern ends, the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563 will reduce their positions and follow up with stop loss at 3750. , today it will first pull up and give 3993 short, conservative 3996 short loss 4000, the lower target is 3925, 3915 and 3900, if it falls below, look at 3890 and 3883.

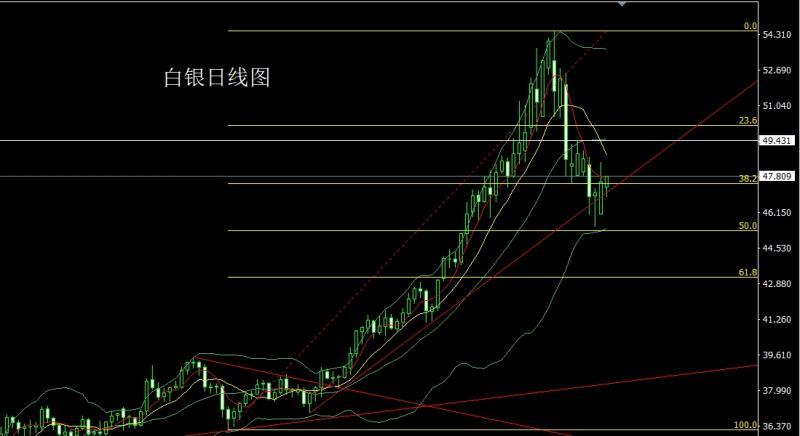

The silver market opened low yesterday at 46.084 and then the market rose directly. The daily line reached the highest level of 48.454 and then the market consolidated. After the daily line finally closed at 47.535, the daily line closed with a big positive line with a long upper shadow line. After this form ended, the longs of 37.8 and 38.8 below followed up at 42. Today, 47.2 is long and the stop loss is 47. The target is 47.7, 48.2 and 48.5-48.7. The pressure leaves the market and prepares to go short.

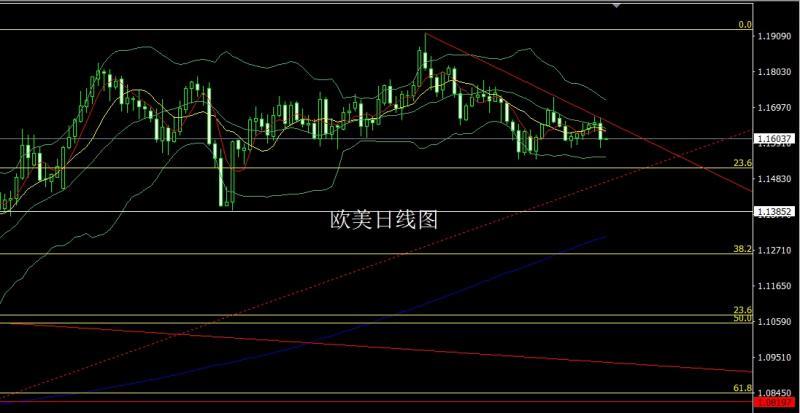

After the European and American markets opened at 1.16499 yesterday, the market first rose to a position of 1.16606 and then fell back. After reaching a position of 1.16168, the market rose strongly. The highest daily line touched the position of 1.16656. After that, the market fell back strongly in the early morning period due to the impact of the Federal Reserve's interest rate decision, and the daily lowest was 1.157. After the position of 66, it rose in late trading. After the daily line finally closed at 1.16000, the daily line closed with a large negative line with a lower shadow line longer than the upper shadow line. After such a form ended, today 1 .16300 short, stop loss below 1.16500, target 1.16000 and 1.15750, 1.15500 and 1.15300.

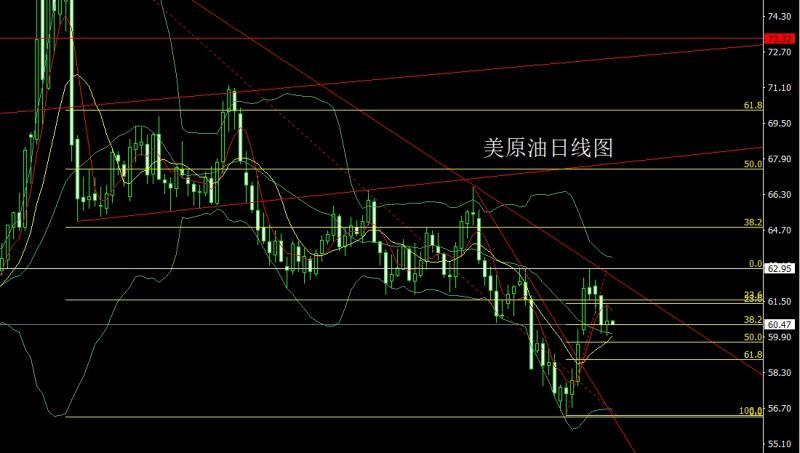

The U.S. crude oil market opened at 60.45 yesterday, and then the market rose slightly to reach 60.77, and then quickly fell back. After reaching a daily low of 59.95, the market rose strongly. The daily high hit a position of 61.3, and then the market surged higher and fell. The daily line After finally closing at 60.61, the daily line closed in the form of a cross star with the upper shadow line longer than the lower shadow line. After this form ended, 61.1 was short today, and the stop loss target below 61.5 was 60.3, 59.5, and 59-58.5.

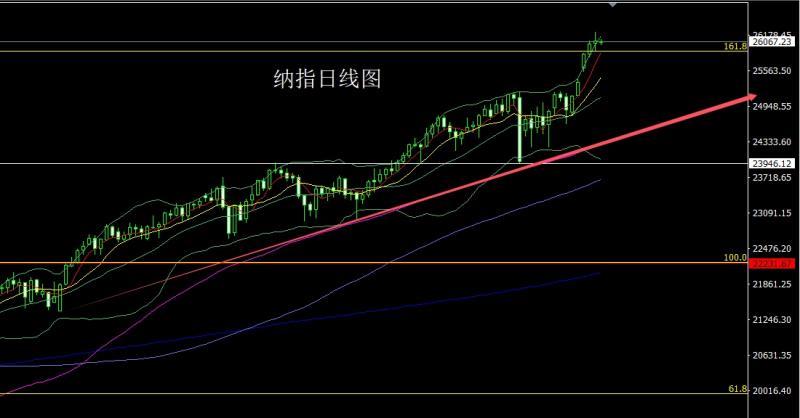

The Nasdaq opened at 26036.93 yesterday, then the market retreated slightly to reach the position of 26019.38, and then the market fluctuated and rose. It reached the position of 26184.2 at the beginning of the US market, and then the market fell back strongly. The daily minimum reached the position of 25904.73, and then rose strongly in the late trading. After the daily line reached the highest position of 26235.12, the market consolidated. After the daily line finally closed at 26082.97, the daily line closed in the form of a long-legged cross star with equal upper and lower shadow lines. After such a form ended, today 26180 short loss 26240, the lower target is 26050 and 26000. and 25900, break the position to see 25850 and 25800-25730.

Fundamentals, yesterday's fundamental market focused on the Fed's interest rate decision. The Fed's October interest rate meeting: cut interest rates by 25 basis points as scheduled, Milan supports a 50 basis point interest rate cut, and Schmid hopes to stay on hold and end the balance sheet reduction from December 1. Will bluntly stated that a December interest rate cut is not a certainty. Officials are deeply divided on December policy. The data vacuum under the government shutdown has made more people cautious and more likely to stay on hold. Powell also mentioned that this is a risk management-style interest rate cut. The current AI boom is different from the last Internet bubble. Therefore, Fed Chairman Powell is hawkish.Stimulated by the remarks, the U.S. index rose strongly, and the gold, silver and non-U.S. markets fell back. Today's fundamentals focus on the initial annual GDP rate of the euro zone in the third quarter at 18:00. In the evening, we will watch the European Central Bank's interest rate decision at 21:15. Later, at 21:45, European Central Bank President Christine Lagarde held a monetary policy press conference. On the same day, China went to Gyeongju, South Korea from October 30 to November 1 to attend the 32nd APEC Economic Leaders’ Meeting and pay a state visit to South Korea.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing the position, the stop loss is followed up and held at 3750. Today, the first pull up gives 3 993 short conservative 3996 short loss 4000. The lower target is 3925, 3915 and 3900. If it falls below, look at 3890 and 3883.

Silver: 37.8 long below and 38.8 long follow up and hold at 42. Today, 47.2 is long and the stop loss is 47. The target is 47.7, 48.2 and 48.5-48.7. The pressure leaves the market and prepares to go short.

Europe and the United States: 1.16300 is short today, stop loss below 1.16500, target 1.16000 and 1.15750, 1.15500 and 1.1530 0.

U.S. crude oil: 61.1 is short today, the stop loss below 61.5 is 60.3, 59.5 and 59-58.5.

Nasdaq: 261 today The target below 80 short loss 26240 is 26050, 26000 and 25900, and the breakout is 25850 and 25800-25730.

The above content is about "[XM Foreign Exchange Decision Analysis]: The eagle calls in the early morning to push the US index, and the gold and silver pressure range is empty". It is carefully www.xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here