Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The list of candidates for next Federal Reserve Chairman has grown longer, waiti

- PMI is positive but the yen falls, and the Japanese economy hides "fatal loophol

- Strong fluctuations clear the market, low gold and silver range

- Hazard hedging declines, gold continues to fall?

- The US dollar index has suffered consecutive setbacks. What kind of signal of ch

market analysis

The Fed's decision was in line with expectations, and Powell's "hawkish" push up the U.S. index!

Wonderful introduction:

You don’t have to learn to be sad in your youth. What www.xm-forex.comes and goes is not worth the time. What I promised you, maybe it shouldn’t be a waste of time. Remember, the icy blue that stayed awake all night, is like the romance swallowed by purple jasmine, but the road is far away and the person has not returned. Where does the love stop?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The Federal Reserve's resolution is in line with expectations, and Powell's 'hawking' pushes up the U.S. index!". Hope this helps you! The original content is as follows:

Asian Market Trends

In the early hours of Thursday morning, Federal Reserve Chairman Powell suppressed market expectations for another interest rate cut in December, and the U.S. dollar index expanded its gains. As of now, the U.S. dollar is quoted at 99.01.

The United States announced a new round of sanctions against Russia, focusing on two oil www.xm-forex.companies.

The Federal Reserve's interest rate meeting in October: cut interest rates by 25 BP as scheduled, Milan supports a 50 BP cut, and Schmid hopes to remain on hold and end the balance sheet reduction from December 1; Powell bluntly stated that an interest rate cut in December is not a certainty, and officials have serious differences on December policy. The data vacuum under the government shutdown has made more people cautious and tend to remain on hold. Powell also mentioned that this is still a risk management-style interest rate cut and that the current AI boom is different from the last Internet bubble.

The Gulf countries in the Middle East collectively announced a 25BP interest rate cut.

The Bank of Canada cut interest rates by 25 basis points as scheduled and also signaled that it would suspend interest rate cuts.

South Korea and the United States have reached a trade agreement, and South Korea will invest US$350 billion in the United States, including US$200 billion in cash. The United States will continue to maintain a 15% www.xm-forex.comprehensive tariff on South Korea, and the automobile tariff will be reduced to 15%.

Summary of institutional views

Mizuho Bank: The Bank of Japan reiterated its stance on "normalizing" interest rates and the market expected an early interest rate hike

Shoki, Chief Strategist of Mizuho BankOmori said the Bank of Japan's statement reaffirmed the authorities' policy stance of "gradual normalization" and prompted market participants to bring forward the expected timing of the next policy adjustment. While the underlying path for monetary policy remains cautious, the clear confirmation of a steady path towards normalization has prompted investors to consider the possibility of further tightening earlier than previously expected. Between now and December, a series of key indicators will be particularly important. The most critical among them are the results of the upcoming spring wage negotiations, price trends in the service industry, and external economic and trade policy dynamics. The message from the authorities is clear: Although the possibility of another rate hike between December and the beginning of the next fiscal year has increased, there is no immediate intention to take action. Therefore, the pace and frequency of policy normalization will remain gradual and dependent on data performance, and attention will be paid to changes in the domestic and international environment.

Swedish Nordic Bank: In the dispute over differences between the Federal Reserve, who leads the policy direction?

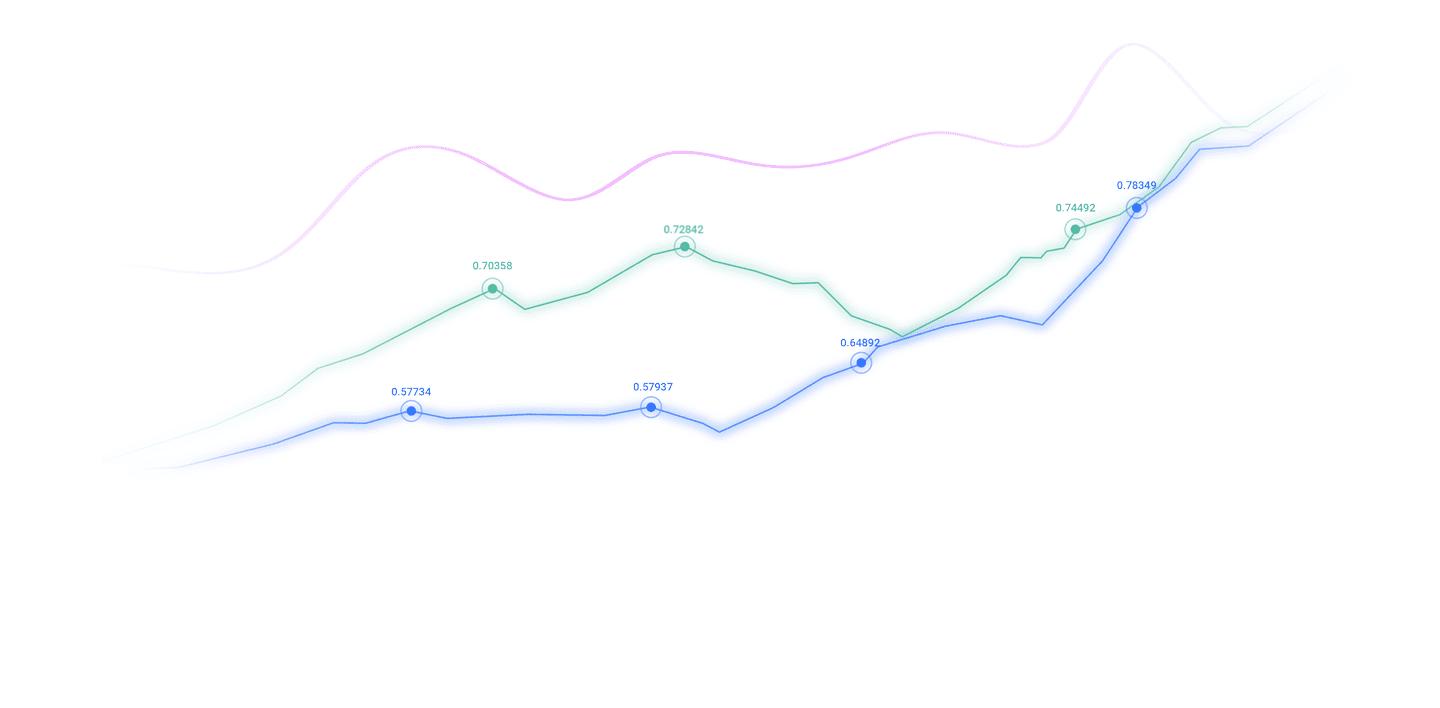

The Federal Reserve cut interest rates by 25 basis points to a range of 3.75%-4.00% as scheduled, but the hawkish signals released in the policy statement and Powell's speech surprised the market. The current probability of the Fed cutting interest rates in December has dropped to about 68% from the full pricing before the meeting, and interest rates are expected to rise above 3% by the end of 2026. Nonetheless, we still maintain our previous forecast for the Fed to cut interest rates by another 25 basis points in December, but both data and speeches will be important factors to watch closely. In addition, we also stick to our previous forecast of another 75 basis point rate cut in 2026, bringing interest rates closer to the Fed's median assessment of the 3% neutral rate.

If economic activity and demand remain strong, the Fed's hawkish view will be supported that policy may end up being less tight and the neutral interest rate may be higher. However, signs of continued cooling in labor demand pose risks for a further rise in unemployment, while the impact of tariffs on inflation has so far been weaker than expected. Additionally, we expect President Trump’s nominee to be the next Fed chair to lean dovish, at least initially.

IGM Group: The Bank of Japan’s decision is basically in line with expectations, but why are the United States and Japan rising rapidly?

The Bank of Japan decided to keep interest rates unchanged at 0.5% today, which was widely expected by the market. However, the 7-2 vote showed that internal pressure to tighten monetary policy continued to increase, but ultimately failed to materialize. This dynamic has only strengthened expectations of continued weakness in the yen. Although Naoki Tamura and Soki Takada both advocated raising interest rates by 25 basis points to 0.75%, they believe that the price stability goal has been basically achieved and price risks are increasing, which shows that there is a hawkish sentiment within the Bank of Japan, but it lacks the political support needed to promote the implementation of the policy. The Bank of Japan's independence remains www.xm-forex.compromised under the influence of Japan's new Prime Minister, Sanae Takaichi.

Economic Journalist Neils Christensen: Powell extinguished expectations for a December interest rate cut, and international spot gold lost its way again

As Fed Chairman Powell extinguished market expectations for a December interest rate cut, international spot goldSpot gold is struggling to find its way. After the Fed cut interest rates by 25 basis points as expected, Powell made it clear at the beginning of his press conference that another rate cut before the end of the year is far from certain. Before Powell's speech, the market generally believed that the probability of a rate cut in December was close to 90%. However, investors currently see only a 60% chance of further easing. Although some economists described Powell's monetary policy statement as dovish, international spot gold remained calm about this cautious attitude and retreated.

While Powell has outlined a more cautious approach, many analysts still expect the Fed to continue cutting interest rates to support a weak labor market. www.xm-forex.commodity analysts said that while inflation remains high, falling interest rates will continue to push down real interest rates, thereby reducing the opportunity cost of international spot gold as a non-yielding asset.

Analyst Stephen Innes: Powell has removed the dovish "safety net" and investors should follow this discipline in the next 35 hours

For traders, the real key is not the rate cut itself, but Powell's silence on the subsequent path. His use of words such as "not an established fact" seemed to warn the market not to view this action as the beginning of an easing cycle. When Powell calmly pointed out that "it is far from certain whether we will continue to cut interest rates in December," the probability of an interest rate cut in December plummeted from 95% to 65%, and international spot gold was hit back below $4,000. This is not a policy shift, but a collapse of the pillar of market certainty.

There is an unspoken rule in the trading world - never rush to reverse an unexpected move by a central bank. Of course, you can test the market, but don’t go all-in on predicting policy shifts. The first day is a shock day and the second day is a readjustment day. This time is no exception. The Fed did more than just fine-tune policy; it shook up markets accustomed to the predictability of rate cuts. Powell's "trap" wasn't a rate hike or a policy U-turn - it was the quiet removal of the market's dovish safety net. It is this loss of certainty, not changes in liquidity, that is to blame for market crashes. Traders can manage risk—they live by it—but doubt is something they cannot put a price on.

So for now, discipline remains: step back, wait, and watch what bond and options traders do. If U.S. Treasury yields fall back, it would suggest that markets will continue to price in line with their own policy realities, and risk assets will follow suit. The next 35 hours will distinguish between knee-jerk reaction and true belief: international spot gold may fall back towards $3,900, the dollar rebound may be excessive due to position liquidation (pay close attention to the dollar trend, this is usually the first signal), and yields will remain strong into the weekend.

The above content is all about "[XM Foreign Exchange Market Analysis]: The Federal Reserve's decision is in line with expectations, and Powell's 'hawking' pushes up the U.S. index!" It is carefully www.xm-forex.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

LiveIn the present moment, don’t waste your present life dwelling on the past or longing for the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here