Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold continues to fluctuate upward, and there is a rebound and it will be more!

- Guide to short-term operations of major currencies on September 3

- Powell's dovish speech boosts gold prices, Russia-Ukraine peace agreement is hig

- European and American trade agreement locked, analysis of short-term trends of s

- Guide to short-term operation of major currencies

market analysis

The bottom hammer is waiting for interest rate cuts, gold and silver will gain first on dips

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM official website]: The bottom hammer is waiting for an interest rate cut, and gold and silver will be more profitable first on dips." Hope this helps you! The original content is as follows:

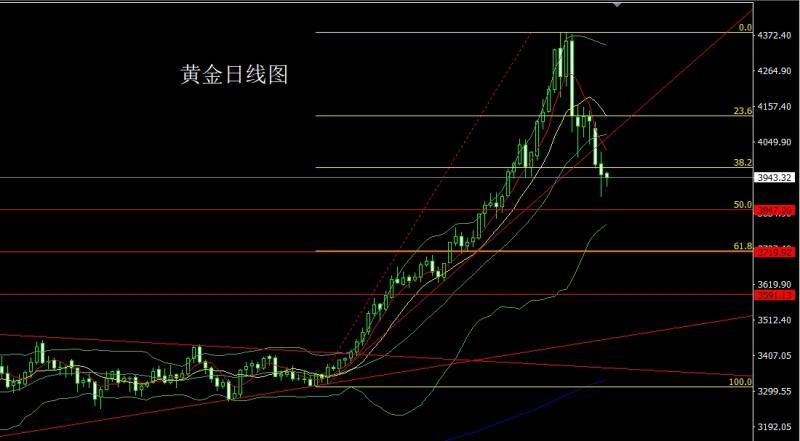

Yesterday, the gold market opened at 3983.6 in early trading. After that, the market first rose to reach 4020.8, and then the market fluctuated strongly and fell back. The daily minimum was 3884. After the .9 position, there was a strange oversold rebound. After the daily line finally closed at 3952.2, the daily line closed in a hammer-like shape with a lower shadow line longer than the upper shadow line. After such a form ended, the daily line had The demand for oversold rebound, in terms of points, the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and the longs of 3563 will be followed up with stop loss at 37 50 holds, today 3923 is more than 3920, stop loss is 3915 conservatively, target is 3960 and 3970, break position is 3982 and 3990-4000.

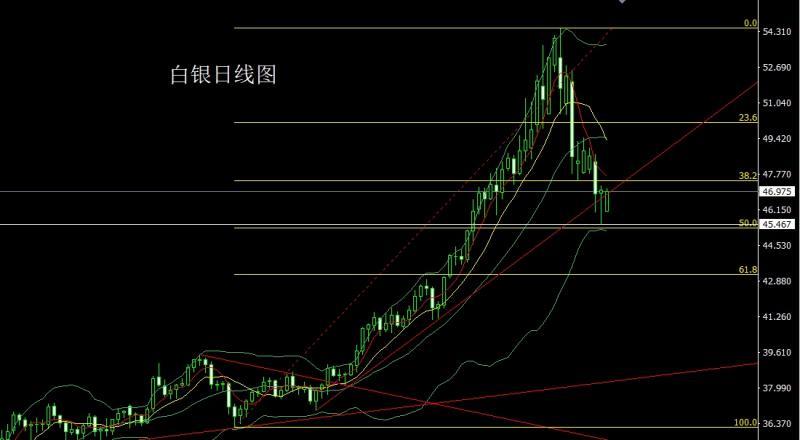

The silver market opened at 46.903 yesterday, and then the market rose slightly to reach 47.21, and then fell back strongly. The daily minimum reached 45.494, and then the market rose strongly, and the daily maximum reached 45.494. After finishing at the position of 47.255, the daily line finally closed at 47.028. The daily line closed in the form of a morning star with a very long lower shadow. After the www.xm-forex.completion of this form, the longs of 37.8 and 38.8 below followed up and were held at 42. Today, 46.2 is long, stop loss is 45.95, target is 46.6 and 47-47.25 and 47.6.

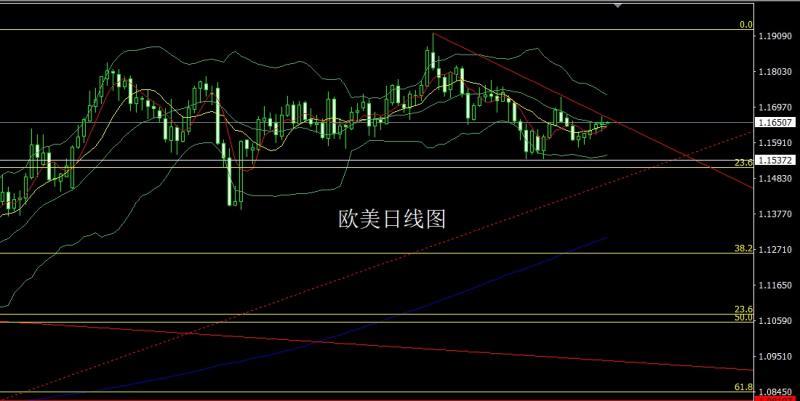

After the European and American markets opened at 1.16435 yesterday, the market first rose to 1.16680 and then fell sharply. The daily low reached 1.16245 and then the market rose again. The daily high reached 1.6687 and then the market fell back. The daily line finally closed at 1.16245. After the position of 1.16515, the daily line closes in the shape of a spindle with the upper and lower shadow lines of equal length. After the end of this form, the stop loss is 1.16100 over 1.16300 today. The target is 1.16600 and 1.16800. If the position is broken, the target is 1.17000-1.17250.

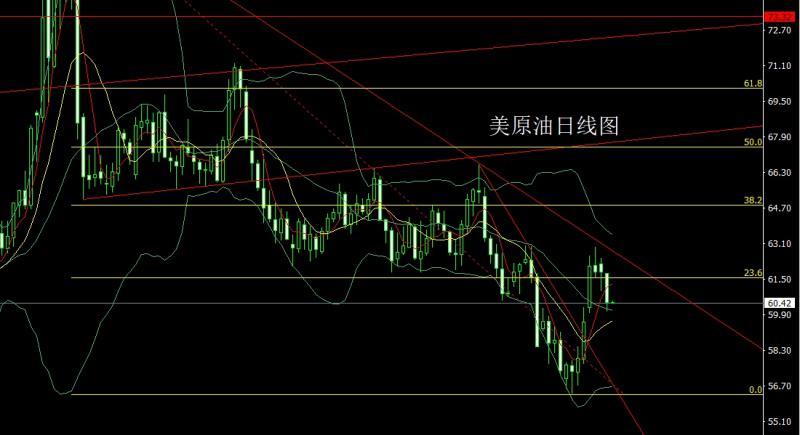

The U.S. crude oil market opened low yesterday at 61.76 and then fell directly. The daily line reached the lowest position of 60.03 and then the market consolidated. After the daily line finally closed at 60.45, the daily line closed at 60.45. The bald big Yinxian with a long lower shadow line has closed. After the end of this pattern, today’s short stop loss of 61.3 is 60.5 and 60 below 61.7, and below it is 59.5 and 59-58.7.

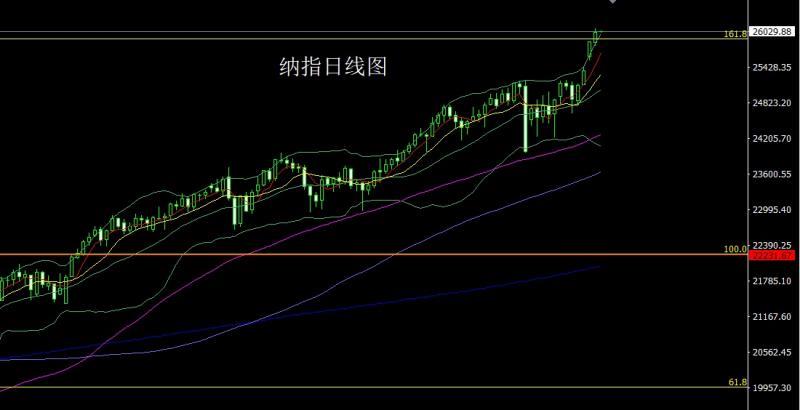

After the Nasdaq opened at 25849.46 yesterday, the market fell first. The daily line reached the lowest position of 25793.4 and then the market fluctuated and rose. The daily line reached the highest position of 26086.31. After that, the daily line closed with a mid-yang line with the same length as the upper and lower shadow lines. After this form ended, today The daily stop loss is 25840, and the target is 26000 and 26090, 26150 and 26200.

Fundamentals, yesterday's fundamentals ADP released the weekly estimate of the US national employment report. In the four weeks to October 11, the average number of new jobs was 14,250. The President of the United States once again criticized the Chairman of the Federal Reserve yesterday, saying that Chairman Powell is either incompetent or bad and will resign "within a few months." Coupled with the expectation that the Federal Reserve will cut interest rates in the early hours of Thursday, the gold and silver market bottomed out last night and rose. Today's fundamentals are the key to this week. The main focus is the monthly rate of the US existing home contract sales index in September at 22:00 and the EIA crude oil inventory in the United States for the week to October 24 at 22:30. and the EIA Cushing, Oklahoma crude oil inventory in the United States for the week to October 24 and the EIA Strategic Petroleum Reserve inventory in the United States for the week to October 24. On the same day, the US President visited South Korea and attended the Asia-Pacific Economic Cooperation (APEC) Leaders Summit in South Korea. Tomorrow morning, focus on the Federal Reserve's FOMC interest rate decision at 2:00. Then watch Federal Reserve Chairman Powell hold a monetary policy press conference at 2:30.

In terms of operation, gold: The longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and the longs of 3563 will be followed up with a stop loss at 3750 after reducing positions. Today, 3923 is conservative. 3920 is long, stop loss is 3915, target is 3960 and 3970, break position is 3982 and 3990-4000.

Silver: 37.8 long below and 38.8 long follow up and hold at 42. Today's 46.2 is long, stop loss is 45.95, target is 46.6 and 47-47.25 and 47.6.

Europe and the United States: Today is 1.16300, stop loss is 1.16100, target is 1 .16600 and 1.16800. If the position is broken, look at 1.17000-1.17250.

U.S. crude oil: today 61.3 short stop loss 61.7, the target below is 60.5 and 60 , if it falls below, look at 59.5 and 59-58.7.

Nasdaq: Stop loss at 25840 for more than 25900 today, target 26000 and 26090, 26150 and 26200.

The above content is all about "[XM official website]: The bottom is hammered and interest rates are expected to be cut, gold and silver will increase first on dips". It is carefully www.xm-forex.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here