Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Weekly rebound is coming, gold and silver continue to go long

- Guide to short-term operation of major currencies

- In the key battle between the Euro 1.17, can the bulls take advantage of the vic

- Silver/USD rises to $38.40, benefiting from weakening USD

- The US dollar has suffered a big defeat! The probability of a 98% interest rate

market news

Super Bank Weekly, Federal Reserve and Bank of Canada expect rate cuts

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Super Central Bank Week, the Federal Reserve and the Bank of Canada expect to cut interest rates." Hope it will be helpful to you! The original content is as follows:

XM Foreign Exchange Market Forecast: Super Central Bank Week, the Federal Reserve and the Bank of Canada expect interest rate cuts

XM Forecast: The importance of economic data to be released this week is from high to low: Federal Reserve interest rate resolution, Bank of England interest rate resolution, Bank of Japan interest rate resolution, and Bank of Canada interest rate resolution. Next, we will interpret it one by one.

▲XM chart

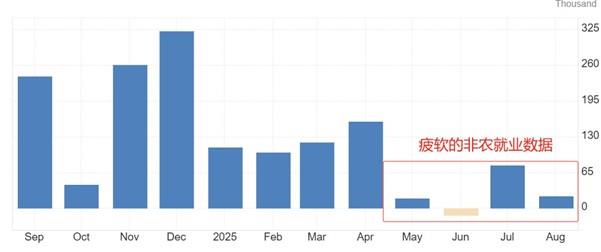

This Thursday at 2:00, the Federal Reserve will announce the results of the September interest rate resolution. Mainstream expectations believe that it will cut interest rates by 25 basis points, and the federal funds rate range will be lowered from 4.25 to 4.5% to 4.0 to 4.25%. The last rate cut by the Federal Reserve was in December 2024. Since the beginning of this year, all Federal Reserve resolutions have remained unchanged. The reason why market participants firmly believe that the Fed restarted interest rate cuts this week is because the recent sharp decline in labor market data in the United States has taken a sharp turn. In March this year, the United States still had 158,000 new non-farm employment. However, in May, the number of new non-farm employment dropped sharply to 19,000, and fell to negative values in June, and continued the low growth trend in July and August. The newly added non-farm employment population is the most important indicator in the US non-farm employment report. The continued decline in data will force the Federal Reserve to change its current tightening monetary policy. In addition, US President Trump has put pressure on the Federal Reserve through various means, forcing it to quickly and significantly cut interest rates according to his own wishes. The overspending budget of the Federal Reserve Chairman’s renovation building and the lawsuits encountered by Fed Director Lisa Cook are typical cases in this regard. Some institutions believe that the Fed will not only cut interest rates this week, but also the rate cut may exceed market expectations.In the period, it reaches 50 basis points. If this is true, market participants will increasingly pessimistic about the future economic prospects of the United States, which is negative for the US dollar index.

▲XM chart

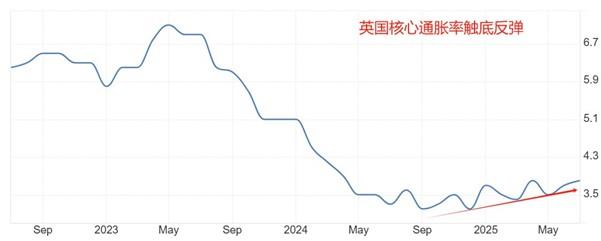

This Thursday at 19:00, the Bank of England will announce the results of the September interest rate resolution, and mainstream expectations believe that it will maintain the 4% benchmark interest rate unchanged. The Bank of England's last interest rate decision was on August 7, when it announced a 25 basis point cut. However, the result of the interest rate cut was reached in the second round of voting, and the voting ratio was 5 to 4, which was very thrilling. Among the Bank of England officials, more and more people oppose interest rate cuts and support the suspension of interest rate cuts. The main reason is that the inflation rate in the UK has shown signs of bottoming out and rebounding. If interest rates are cut blindly to provide the market with excess liquidity, the problem of high inflation may reappear. According to data, the annual rate of core CPI in the UK in July was 3.8%, higher than the previous value of 3.7%, setting a record high since May 2024. The inflation standard recognized by the Bank of England is between 2 and 3%, and the current inflation level seriously exceeds the target, which is the core reason why the Bank of England chose to suspend interest rate cuts.

▲XM chart

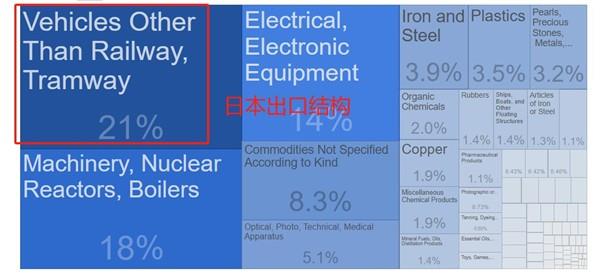

During the Asian session this Friday, the Bank of Japan will announce the results of the September interest rate resolution. Mainstream expectations believe that it will remain unchanged and maintain the 0.5% benchmark interest rate unchanged. Unlike the Fed's expectation of interest rate cuts, market participants' expectations of the Bank of Japan are biased towards hikes. Because Japan's latest core inflation rate is 3.1%, which is at a high level, which is inconsistent with the current extremely low interest rate of 0.5%. If Japan does not raise the benchmark interest rate to normal as soon as possible, Japan's www.xm-forex.comprehensive prices may be out of control driven by high demand. However, Japan has been hit by US tariff policies, and it is still uncertain whether the export industry can maintain a healthy state, and the Bank of Japan does not dare to raise interest rates rashly. The United States is Japan's largest exporter, but under Trump, the United States imposes a 15% tariff on goods exported by Japan, and the tariff rates on cars and textiles are higher. In Japan's export structure, automobiles account for as high as 21%, ranking first, and have suffered the most impact. If Trump continues to increase tariffs in the future, Japan's macroeconomics may fall into recession. We believe that the Bank of Japan will not easily restart interest rate hikes until the impact caused by US tariff policies is www.xm-forex.completely clear.

▲XM chart

This Wednesday at 21:45, the Bank of Canada will announce the results of the September interest rate resolution. Mainstream expectations believe that it will cut interest rates by 25 basis points, and the benchmark interest rate may drop from 2.75 to 2.5%. Three interest rate resolutions since April today, CanadaThe bank has maintained the benchmark interest rate unchanged. Since April, in the face of the sudden tariff policy of the United States, the Bank of Canada has dared not act rashly and can only choose to keep interest rates unchanged. Initially, the Bank of Canada was counting on trade negotiations and hoping that the United States would cancel all relevant taxes, but this method turned out to be unworkable. Canada's largest trading country is the United States, and its largest export is crude oil. Nowadays, the United States imposes taxes on Canada, and international oil prices are extremely sluggish, and Canada's economic outlook is pessimistic. In order to prevent the macro economy from falling into recession, the Bank of Canada had to restart interest rate cuts as soon as possible.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times, analysts' views may change and updates will not be notified separately.

The above content is all about "[XM Forex]: Super Central Bank Week, the Federal Reserve and the Bank of Canada expect interest rate cuts" and is carefully www.xm-forex.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here