Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- In the tug-of-war before the pound 1.35 mark, who will win the bulls and bears?

- Jackson Hole Annual Meeting Releases Dove Signal, U.S. Treasury Yield Curve Is S

- 7.28 Analysis of the trend of gold and crude oil market today and the latest exc

- Improving risk sentiment suppresses the US dollar, is the trend of the Federal R

- Gold breaks through 3300 as scheduled, will gold shorts continue to go crazy?

market analysis

The pregnancy line is sorted for data, and gold and silver are back to make short and long

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have www.xm-forex.comfort; missing www.xm-forex.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Pregnancy line sorting data, gold and silver fall back and make short and long". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market consolidated in the range. The early opening was at 3314.7 and the market fell first. The daily line was at 3307.5. Then the market fluctuated strongly. During the US session, the daily line reached the highest position of 3334.3 and then the market consolidated at the end of the trading session. After the daily line finally closed at 3326, the daily line closed with a small positive line with an upper influence slightly longer than the lower shadow line. After this pattern ended, the daily line was pregnant with the structure of the daily line. At the point, today's 3317 is conservative 3315 and 3311. The target is 3325 and 3331 and 3335 pressure.

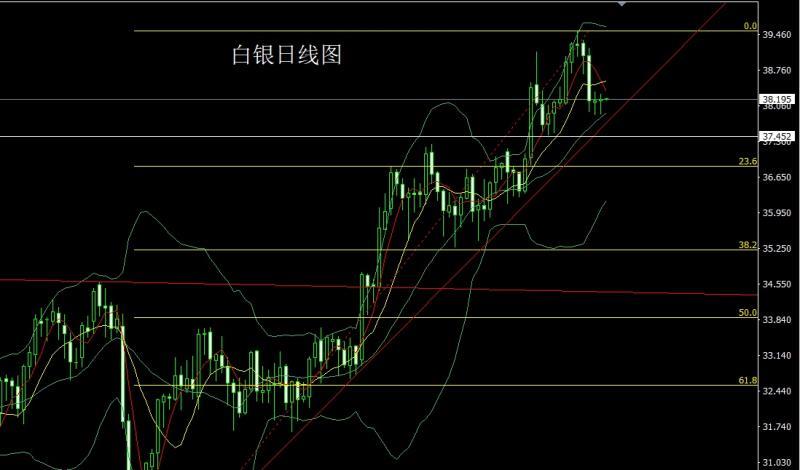

The silver market opened at 38.155 yesterday and the market fell first. The daily line was at the lowest point of 37.894 and then the market rose strongly. The daily line reached the highest point of 38.287 and then the market consolidated. After the daily line finally closed at 38.189, the daily line closed with a very long lower shadow line. After this pattern ended, the daily line was supported by the double star support. At the point, the daily line was 37.95 long stop loss 37.8 today, and the target was 38.15 and 38.35 and 38.5.

European and American markets opened at 1.15884 yesterday and the market rose slightly, and then the market fell sharply. The daily line was at the lowest point of 1.15182 and then the market consolidated. After the daily line finally closed at 1.15447, the daily line closed with a very long lower shadow line. After this pattern ended, if the market first pulled up, it would give 1.15750 short stop loss 1.15900. The target below the target is 1.15400 and 1.15200 and 1.15000 and 1.14800.

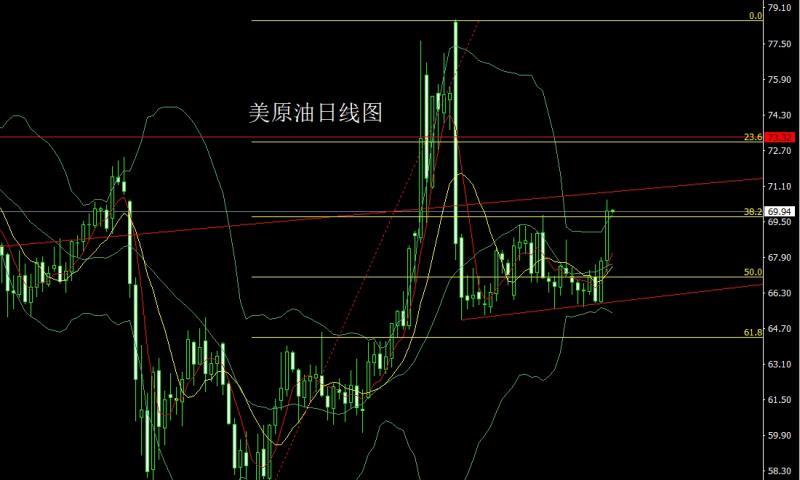

The U.S. crude oil market opened at 67.76 yesterday and the market fell first. The daily line was at the lowest point of 67.23 and then the market rose strongly. The daily line reached the highest point of 70.49 and then the market consolidated. The daily line finally closed at 69.97 and then the market closed with a large positive line with a lower shadow slightly longer than the upper shadow. After this pattern ended, it continued to be low. At the point, the 68.8 long stop loss was 68.2 today, the target was 69.6 and 70.2 and 70.5, and the break was 70.8 and 71.

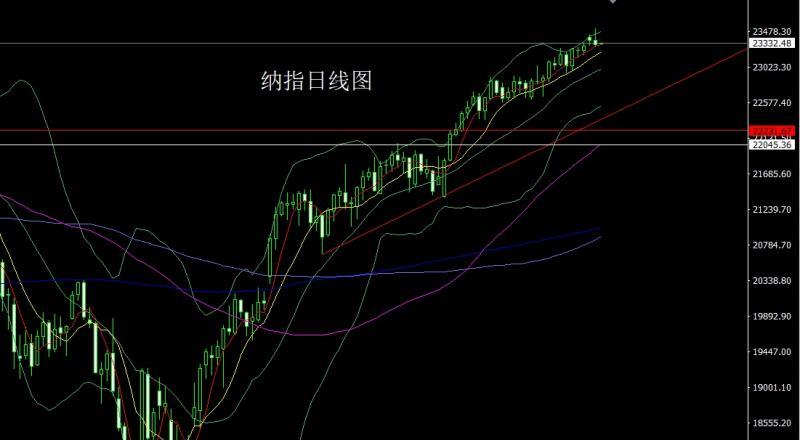

Nasdaq market opened at 23365.29 yesterday and the market rose first to give the position of 23513.97. The market quickly fell during the US session and the sun was at the lowest point of 23280.85. After the market was consolidated, the daily line finally closed at 23310.44. The daily line closed in a very long inverted hammer head pattern. After this pattern ended, today's 23430 short stop loss 43490, the target below is 23280, and the falling below is 23230 and 23180 and 23150.

Fundamentals, yesterday's fundamentals. The US President said that if he does not reach a ceasefire agreement with Ukraine within 10 days, he will impose tariffs on Russia. If sanctions are imposed on Russia, he will not worry about oil prices. Therefore, crude oil prices are pushed up, and IM F raises the world economic growth forecast this year to 3%, raises the U.S. growth forecast to 1.9%, and raises China's growth forecast to 4.8%. This means that the global economy is currently recovering, and today's fundamentals focus on the initial annual GDP annual rate of the euro zone at 17:00. Then look at the number of U.S. ADP employment in July at 20:15, with an expected 75,000 people in this round, with a previous value of -33,000 people. Then look at the initial annualized quarterly rate of U.S. real GDP annualized quarterly rate of U.S. real personal consumption expenditure in the second quarter, and then look at the initial annualized quarterly rate of U.S. core PCE price index in the second quarter. Then look at the monthly rate of U.S. existing home contract sales index in June at 22:00, and later look at the monthly rate of U.S. EIA crude oil inventories and U.S. from 22:30 to July 25.EIA Cushing crude oil inventories in the week of July 25 and EIA strategic oil reserves inventories in the week of July 25. Tomorrow morning, the Federal Reserve FOMC announced its interest rate decision at 2:00. and Fed Chairman Powell held a monetary policy press conference at 2:30. This round of expected interest rate cuts will not be expected, but under repeated pressure from the US president, it is worth paying attention to whether the Fed's attitude can change.

In terms of operation, gold: today's 3317 is more conservative, 3315 is more stop loss 3311, and the target is 3325 and 3331 and 3335 pressure.

Silver: 37.95 long stop loss today 37.8, target 38.15 and 38.35 and 38.5.

Europe and the United States: If the market rises first, give 1.15750 short stop loss 1.15900, below the target 1.15400 and 1.15200 and 1.15000 and 1.14800.

US crude oil: Today 68.8 long stop loss 68.2 on the day, the target is 69.6 and 70.2 and 70.5, and the break is 70.8 and 71.

Nasdaq: 23430 short stop loss 43490 today, the target is 23280 below, and the target is 23230 and 23180 and 23150.

Yesterday, 3330 short 3316 short position and exit

The above content is all about "[XM Forex]: Pregnancy line sorting data, gold and silver pull back and make short and long", which was carefully www.xm-forex.compiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here